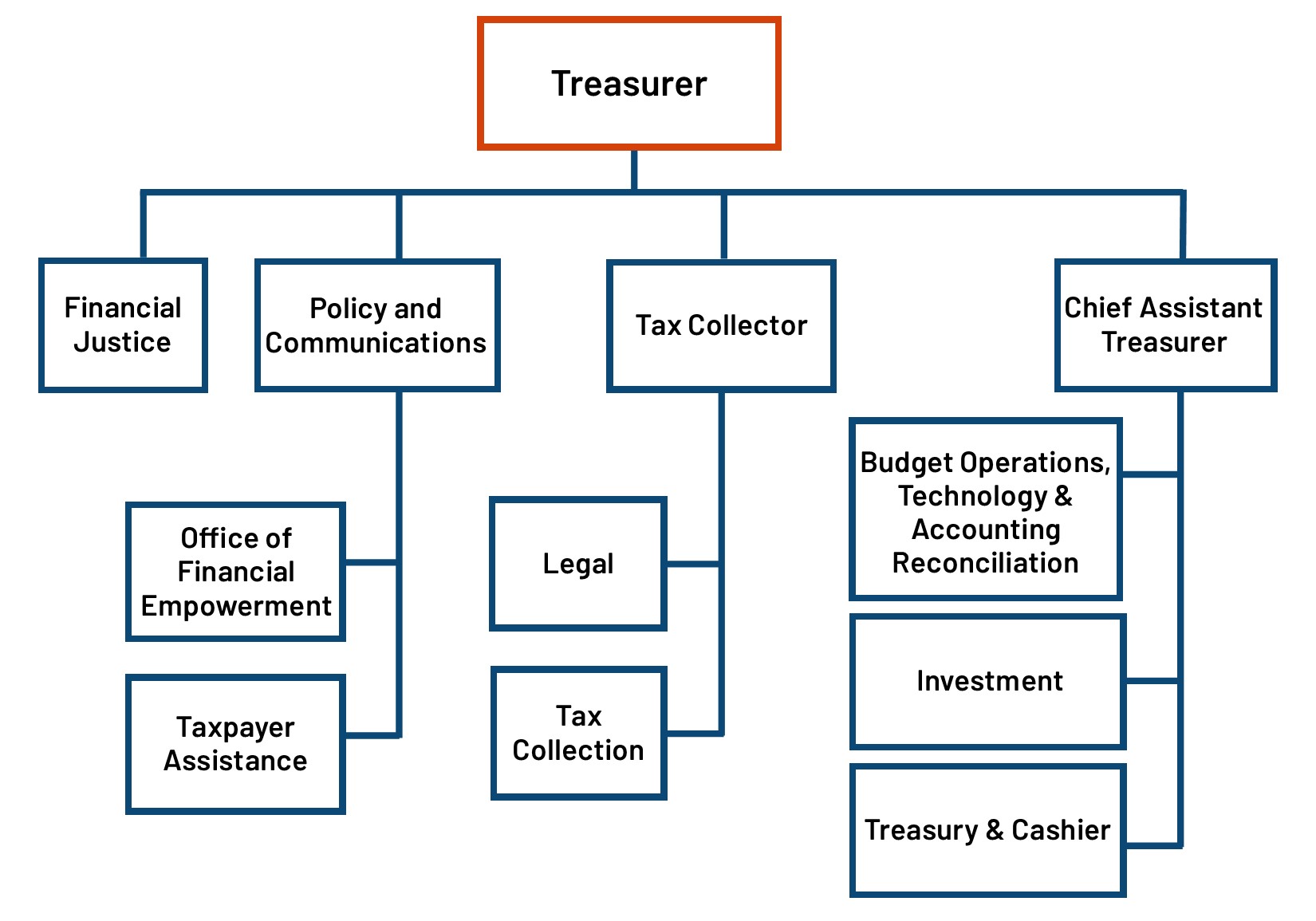

Overview

The position of San Francisco Treasurer is an elective office created by the City Charter in 1850. In July 1979, a charter amendment added the office and duties of Tax Collector to the Treasurer’s responsibilities. The Office of the Treasurer & Tax Collector serves as the banker, collection agent, and investment officer for the government of San Francisco, the only combined city and county in the state of California. The Office of the Treasurer & Tax Collector serves two basic functions for the citizens of the City and County of San Francisco:

- The collection of taxes and other city and county revenue. Through mail, in person in the City Payment Center, and now through the Internet, the Office collects and deposits taxes and other obligations paid to the City, including business taxes, property taxes, and fees for various business licenses and permits that are required by the Municipal Code. Tax Collection units collect over $5 billion annually in property taxes, business taxes, and license fees. Additionally, the Office investigates and collects unreported and delinquent tax obligations. Through the City Payment Center and the SFGov on-line City Services website, the Office contracts to collect current and delinquent obligations owed to other City Departments, such as the Water Department and Department of Public Health.

The conservation and oversight of monies before disbursement. The Treasurer manages all city funds in order to gain the maximum return with low risk and high liquidity, including investing the City’s portfolio of pooled funds. The Treasurer works with all City departments to ensure that funds are received, deposited, and reconciled as quickly and accurately as possible, so as to provide maximum interest and investment returns for the people of San Francisco. The Office administers and monitors the deposit accounts and wire transactions of all City agencies and contracts with banks for financial services. The Office also disburses payments on the City’s General Obligation municipal bonds.

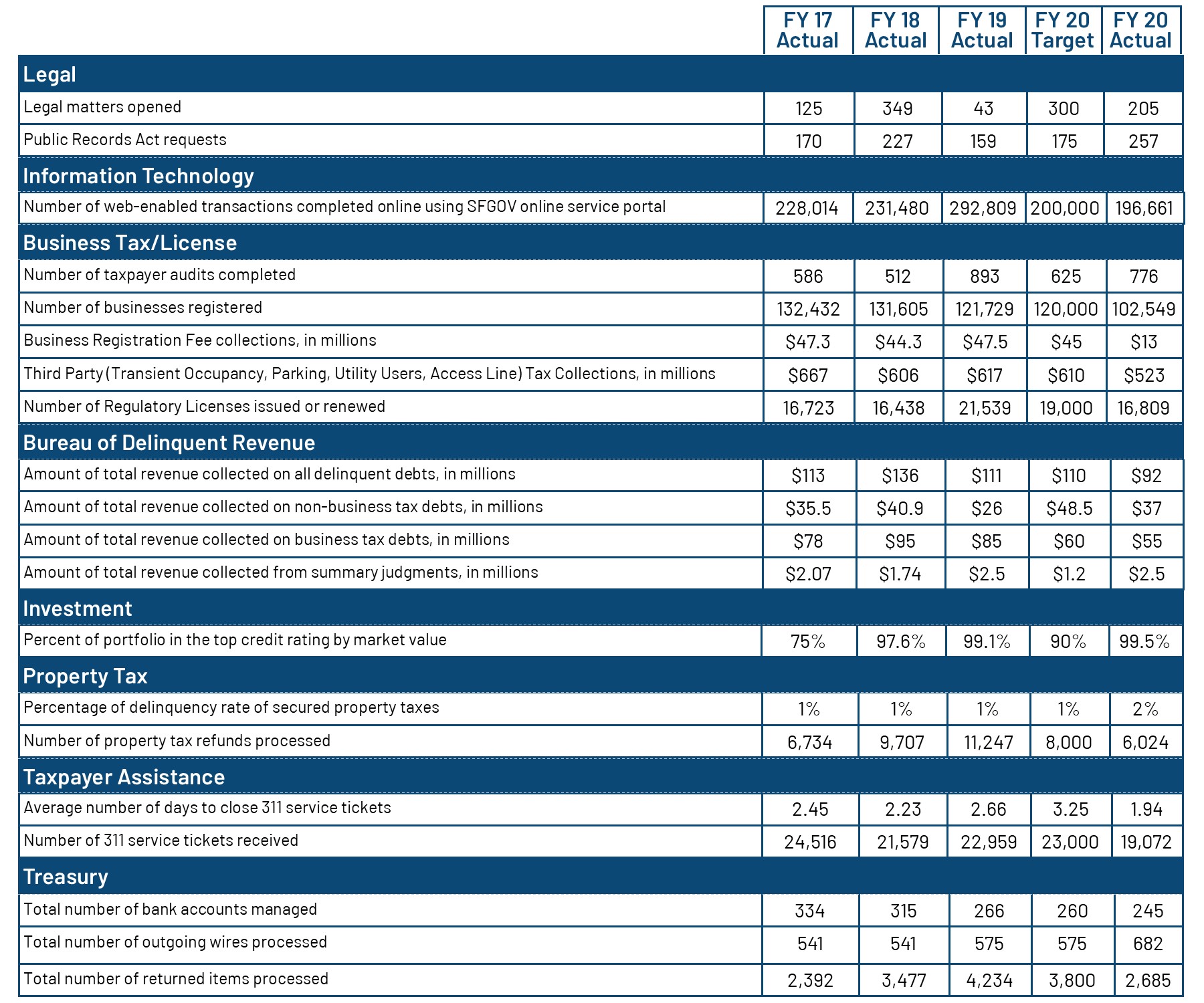

Performance Measures

Accomplishments During COVID-19

Deferred Business Taxes and Fees

See Treasurer Cisneros' presentation to the Small Business Commission on how TTX is supporting small businesses. Given the COVID-19 related changes to tax deadlines, the Office of the Treasurer & Tax Collector re-worked existing taxpayer communications and crafted new ones to inform the San Francisco businesses about these changes.

# Businesses Impacted | Amount Deferred | Original Deadline | New Deadline | |

|---|---|---|---|---|

Quarterly Business Taxes | 8,050 | $5,400 avg | April 30 | February 2021 |

| License Fees | 11,000 | $14 million | March 31 | September 30 |

| Business Registration Fees | 89,000 | $49 million | June 1 | September 30 |

Extended Property Tax Deadline & Encouraged Penalty Waivers

Extended Property Tax Deadline

- TTX worked with the Board of Supervisors on legislation to take the unprecedented step of extending the property tax deadline from April 10 to May 15.

- San Francisco was one of only two California counties that provided additional time to pay property taxes and the only county to extend the deadline as far as May 15.

- We sent two multi-lingual mailings to all parcels not paid by the deadline, with one outlining in-person payment process.

- Re-opened offices May 13-15 for in-person cash payments. These efforts were led by Property Tax, Cashiering and TPA staff.

- The extra time and communication resulted in 98.58% ($3.27 billion) in property tax revenue being collected on time.

Encouraged COVID-19 Penalty Waivers

- Simultaneously created a solution for taxpayers who are unable to pay their property taxes by the deadline because of the COVID-19 crisis.

- TTX encouraged taxpayers to submit a request for a penalty waiver and made the process as simple as a click of the button.

- We then quickly implemented the Governor's Executive Order that provided a further extension to pay. If a small business was approved for a waiver and unable to pay property taxes because of the COVID-19 crisis, they now have until May 6, 2021 to pay their bill without incurring any late payment penalties.

Financial Resources for Businesses & Workers

- Smart Money Coaching Program - served 600 clients and transitioned our free, confidential, one-on-one financial coaching to phone and video appointments.

- Amplifying City Resources - the Office of Financial Empowerment (OFE) has been amplifying City, state and federal resources meant for small businesses and workers impacted by COVID-19 via social media, including hosting a series of Facebook Live conversations.

- Kindergarten to College Report - K2C issued a report on saving for college during COVID-19. The report used K2C program data to show how COVID-19 exacerbates racial and economic inequalities.

- Bank Surveys and Report - OFE staff also surveyed banks about their participation in the Paycheck Protection Program, and about their response to COVID-19 related to consumer and small business relief . Survey results were synthesized to create a report on how banks have responded and makes recommendations for the future, with a specific focus on black and brown communities. This was done in conjunction with the California Reinvestment Coalition.

- COVID-19 Resource Website - OFE developed a website with COVID-19 resources, including listing relief available from local and national banks and credit unions.

- Emergency Prepaid Cards for Low-Income Residents - TTX staff worked with Human Services Agency staff and US Bank to disburse emergency funding via prepaid cards to low-income San Franciscans who are experiencing food insecurity during the pandemic. TTX’s Office of Financial Empowerment provided guidance during this process, assuring that the cards were easy to use and non-predatory.

- PUC Discounts - OFE staff assisted San Francisco Public Utilities Commission in their COVID-19 response plan to provide discounts for customers impacted by the downturn.

Economic Recovery Task Force

Treasurer Cisneros served as Co-Chair of the Task Force. See Economic Recovery Task Force Meeting Information

TTX supported the Economic Recovery Task Force, focusing on job and business support:

- Completed policy research on problems and proposals identified by the task force.

- Provided analysis based on criteria identified by the task force, including equity, feasibility, and cost/benefit.

- Work was incorporated into the final task force report issued in September 2020.

Continued Timely Taxpayer Assistance

- Staff are working remotely but continue answering customer calls within three business days, the standard window of time.

Developed and implemented a temporary PIN Reset Process for taxpayers.

Issued Temporary Business Registration Certificates via email.

Setting up phone appointments with taxpayers who have difficult cases or multiple questions.

Remotely training staff for the New Permit Center at 49 Van Ness using Microsoft Teams and screen sharing

Stepping Up as Disaster Service Workers

- 50 DSW spots have been filled by TTX staff

- 31 staff currently assigned

- Assignments have ranged in duration from 1 day to 2 months

- Bilingual staff have filled key assignments

Positions TTX Staff Have Filled:

Provided Fine & Fee Relief

The Financial Justice Project:

- Worked to become first county in the nation to make jail phone calls free and eliminate markups in the jail store/commissary

- Issued report on City actions to alleviate fines, fees and collections during COVID-19

- Eliminated overdue library fines and outstanding debt from these fines

- Launched SF Museums For All in partnership with Mayor and Human Services Agency

Other Accomplishments

Suspended Certain Delinquent Collection Practices including stopped the following activities for the duration of the COVID-19 crisis:

- Post-judgment collections (for example, bank levy and wage garnishments)

- Small courts claims filings

- Summary judgments

- Citation issuance

- Property tax auctions

- In conjunction with the San Francisco Department of Public Health and San Francisco Municipal Transportation Agency (MTA), suspended the collection of certain obligations owed to Zuckerberg San Francisco General Hospital and the SFMTA.

Reimagined City's Give2SF Payment Platform

Worked with vendors to reimagine and repurpose the City’s Give2SF payment platform so the City could receive donations for the San Francisco COVID-19 Emergency Response and Recovery Fund.

- Resulted in millions in donations that have gone to small businesses and non-profits, hunger relief, child care providers.

Looking Ahead

Implement voter-initiated tax measures and tax deferral efforts due to COVID-19 as directed by the Board and Mayor

Provide high quality customer service using new modes of engagement that are direct, real time and contactless

- Extend contactless payments citywide while reducing costs and risks and improving banking practices

Biographies

José Cisneros, Treasurer

José Cisneros, Treasurer

José Cisneros is the elected Treasurer for the City and County of San Francisco. As Treasurer, he serves as the City’s banker and Chief Investment Officer, managing all tax and revenue collection for San Francisco. Appointed in 2004, and first elected in 2005, Cisneros has used his experience in the tech and banking industries to enhance and modernize taxpayer systems and successfully manage the City’s portfolio through a major recession.

Treasurer Cisneros believes that his role of safeguarding the City’s money extends to all San Francisco residents, and continues to expand his role as a financial educator and advocate for low-income San Franciscans through award-winning programs like Kindergarten to College, Bank On San Francisco and the Financial Justice Project. Cisneros served as Vice Chair on the President’s Advisory Council on Financial Capability for Young Americans, and is currently Co-Chair of the Cities for Financial Empowerment Coalition.

Prior to his role as Treasurer, Treasurer Cisneros served as Deputy General Manager for the San Francisco Municipal Transportation Agency. In this capacity, he managed MUNI’s $7 billion capital program designed to repair, replace and enhance system assets – including the 3rd Street Rail extension serving Chinatown, Mission Bay and the residents of Bay View and Hunters Point. Before working at MUNI, Treasurer Cisneros served as a member of the MTA Board of Directors and was instrumental in creating Proposition E, the Muni Reform Charter Amendment.

Treasurer Cisneros has a strong business background in the private sector, previously working for IBM Corporation and Lotus Development Corporation as a Senior International Product Manager. Prior to this, he was an Assistant Vice President at Bank of Boston where he managed financial product portfolios valued at over $100 million.

Treasurer Cisneros lives with his husband in San Francisco. He received his Bachelor of Science from Sloan School of Management at the Massachusetts Institute of Technology (MIT).

Tajel Shah, Chief Assistant Treasurer

Tajel Shah, Chief Assistant Treasurer

As Chief Assistant Treasurer, Tajel Shah serves as Deputy to José Cisneros and manages investments, banking, cashiering, budget, solutions management, IT and human resources for the Office of the Treasurer & Tax Collector.

Ms. Shah joined the organization in January 2008. Prior to joining the Treasurer & Tax Collector, she managed policy and planning for the Department of Children, Youth and their Families for several years. Ms. Shah comes to the office with a unique blend of public and private sector experience, which includes leading global expansion for Organic Inc. – an internet company and managing several of their Fortune 500 clients. She also served as the first woman of color to lead the national advocacy organization, United States Student Association.

Ms. Shah grew up in New Jersey and holds a B.A. from Rutgers University. She lives in San Francisco with her husband and two children and serves on several boards and commissions, including the San Francisco Unified School District’s Quality Teacher and Education Oversight Committee.

David Augustine, Tax Collector

David Augustine, Tax Collector

In March 2013, Treasurer José Cisneros appointed David Augustine as San Francisco Tax Collector. The San Francisco Tax Collector is responsible for all tax collection in the City and is the ex offico license collector under California law.

Mr. Augustine joined the Office in 2004 as Policy & Legislative Manager, and was instrumental in the implementation of the Treasurer’s many innovative social programs, including Bank on San Francisco, Kindergarten to College, and the Working Families Credit program. As Tax Collector Attorney he represented the office in a number of bankruptcy proceedings and coordinated collections work with the Bureau of Delinquent Revenue.

Prior to joining the City, Mr. Augustine worked in municipal public finance, and with the New York City Mayor’s Office. He holds a J.D. from Stanford Law School and a B.A. in Political Science from Swarthmore College. He is a member of the California State Bar. He has attended the Senior Executives in State and Local Government program at the Kennedy School, and has served on the IRS Advisory Committee on Tax Exempt and Government Entities. Mr. Augustine is a native of the San Francisco Bay Area and resides in San Francisco.

Amanda Fried, Chief of Policy and Communications

Ms. Fried oversees taxpayer assistance, communications, legislation and financial empowerment initiatives for the Office of the Treasurer & Tax Collector.

Ms. Fried oversees taxpayer assistance, communications, legislation and financial empowerment initiatives for the Office of the Treasurer & Tax Collector.

Ms. Fried joined the organization in October 2014. Prior to joining the Office of the Treasurer & Tax Collector, she served as Deputy Director in the Mayor’s Office of Housing, Opportunities, Partnerships and Engagement (HOPE) for Mayor Ed Lee, as a Senior Advisor to the Mayor in New York City, and as a legislative aide.

Ms. Fried grew up in Philadelphia and earned a B.A. in Political Science and Urban Studies from Stanford University, and an Masters in Public Administration from the New York University Wagner School of Public Service. She lives in San Francisco with her family.

Deferred Business Taxes and Fees.

Deferred Business Taxes and Fees.  Extended Property Tax Deadline & Encouraged Penalty Waivers.

Extended Property Tax Deadline & Encouraged Penalty Waivers.  Providing Financial Resources for Businesses & Workers.

Providing Financial Resources for Businesses & Workers.  Treasurer Cisneros Co-Chaired Economic Recovery Task Force.

Treasurer Cisneros Co-Chaired Economic Recovery Task Force.  Continued Providing Timely Taxpayer Assistance.

Continued Providing Timely Taxpayer Assistance.  Stepping Up as Disaster Service Workers.

Stepping Up as Disaster Service Workers.  Provided Fine & Fee Relief.

Provided Fine & Fee Relief.  Other Accomplishments.

Other Accomplishments.